Perusing Crypto Charting money diagrams is a principal expertise for anybody engaged with exchanging or putting resources into digital currencies. Here are a vital parts and moves toward help you comprehend and investigate cryptographic money diagrams: Graphing is a fundamental expertise for anybody engaged with exchanging or putting resources into digital currencies. It includes investigating value developments and examples to go with informed choices. Here is a manual for crypto graphing:

1. Pick an Exchanging Stage:

Select a legitimate digital currency trade that gives hearty diagramming devices. Famous decisions incorporate Binance, Coinbase, Kraken, and others

Most effective method to Pick a Cash Pair for Cryptocurrency

Cryptographic money trades list different exchanging matches, addressing the swapping scale between two digital currencies (e.g., BTC/USD, ETH/BTC). Pick a couple pertinent to your inclinations. Choosing an exchanging pair is an essential choice that relies upon your exchanging technique, risk resilience, and market examination. Here are a few variables to consider while picking an exchanging pair the digital currency market:

- Examination and Information:

Pick exchanging matches for digital currencies that you are know all about and have explored completely. Grasping the fundamental innovation, project objectives, and local area opinion can give significant bits of knowledge.

- Liquidity:

Liquidity is fundamental for effective exchanging. Matches with higher exchanging volumes typically have more tight offered ask spreads, lessening the effect of slippage. Significant digital forms of money like Bitcoin (BTC) and Ethereum (ETH) commonly have high liquidity.

- Unpredictability:

Consider the degree of unpredictability related with an exchanging pair. A few brokers lean toward profoundly unpredictable matches for the capability of bigger cost developments, while others might pick more steady coordinates.

- Relationships:

Dissect the connection between’s various cryptographic forms of money. A few coins might have areas of strength for a, meaning they will generally move in a similar course, while others might be contrarily related. Understanding these connections can assist with broadening your portfolio.

- News and Occasions:

Remain informed about news and occasions connected with the digital currencies in the pair you are thinking about. News can fundamentally affect cost developments, so monitoring potential impetuses is essential.

- Specialized Examination:

Utilize specialized examination to distinguish patterns, backing and opposition levels, and expected passage and leave focuses. Different exchanging matches may display unmistakable examples and ways of behaving.

- Trade Determination:

Pick a respectable and secure cryptographic money trade that offers the exchanging matches you are keen on. Consider factors, for example, expenses, UI, security elements, and client care.

- Project Essentials:

Evaluate the basics of the digital currencies in the pair. Consider factors, for example, the improvement group, associations, use case, and generally project vision. Solid basics can add to the drawn out progress of a cryptographic money.

- Risk Resilience:

Assess your gamble resistance and monetary objectives. Some exchanging matches might be less secure yet offer higher expected returns, while others might be more steady however with lower benefit potential.

- Expansion:

Broadening your exchanging portfolio across various exchanging matches can assist with spreading risk. Try not to place all your capital into a solitary pair, as this could open you to huge misfortunes on the off chance that that specific market encounters unfavorable developments.

- Administrative Contemplations:

Know about administrative contemplations and limitations that might apply to explicit cryptographic forms of money or exchanging matches your area. Remain agreeable with nearby guidelines.

Recollect that the cryptographic money market is dynamic, and conditions can change quickly. Routinely reevaluate your exchanging matches in light of market advancements and your developing exchanging procedure. Furthermore, consider beginning with a little position and bit by bit expanding your openness as you acquire insight and certainty.

Crypto Charting Grasping Time spans:

Graphs can be seen in various time spans, like 1-minute, 5-minute, 60 minutes, 1-day, and so on. More limited time spans give more granular information, while longer time periods give a more extensive point of view. Pick the time span that lines up with your exchanging or venture technique.

Understanding and picking the perfect opportunity range, or time span, is pivotal while dissecting cryptographic money outlines. The decision of time period impacts the degree of detail in the cost developments you notice. Here are some normal time spans and their qualities:

- 1-Moment and 5-Minute Outlines Crypto Charting:

These time periods give exceptionally point by point data and are frequently utilized by informal investors and hawkers. They show cost developments over a brief period, taking into consideration fast independent direction.

- 15-Moment and 1-Hour Outlines:

More limited term dealers and swing brokers might utilize these time spans. They offer a harmony between point by point data and a more extensive viewpoint, catching momentary patterns and cost designs.

- 4-Hour and Everyday Diagrams:

These time periods are famous among swing brokers and financial backers. They give a more extensive perspective on value developments and assist with recognizing medium-term patterns and key help/opposition levels.

- Week after week and Month to month Graphs:

Financial backers and those with a drawn out viewpoint frequently allude to week after week and month to month graphs. These time spans are valuable for grasping the general pattern, long haul designs, and huge help/obstruction zones.

Variables to Consider While Picking a Time span:

- Exchanging Style:

Consider your exchanging or venture style. Informal investors might incline toward more limited time spans, while long haul financial backers might zero in on everyday, week by week, or month to month graphs.

- Time Responsibility:

Survey the time you can commit to observing the business sectors. More limited time spans require more continuous consideration, while longer time spans take into account a more loosened up approach.

- Unpredictability:

Unpredictability will in general diminish as the time period increments. In the event that you’re alright with higher unpredictability and quick cost changes, more limited time spans might be appropriate. Alternately, longer time periods are related with smoother, more steady patterns.

- Investigation Type:

The kind of examination you use might impact your decision of time span. For instance, essential investigation is in many cases applied on longer time periods, while specialized examination can be utilized on different time periods.

- Objectives and Technique:

Think about your monetary objectives and exchanging technique. Assuming you’re searching for easy gains, more limited time periods may be fitting. Assuming you’re centered around long haul development, longer time periods are more significant.

Economic situations:

Different time periods might be more appropriate contingent upon current economic situations. For instance, during times of high instability, more limited time periods might give more clear section and leave focuses.

- Affirmation from Various Time spans:

Merchants frequently utilize a multi-time span examination approach, where they inspect a similar resource on various time periods to get an extensive view. This can assist with affirming patterns and distinguish expected inversions.

Recall that there is nobody size-fits-all methodology, and the best time period for you relies upon your singular inclinations, objectives, and the particular attributes of the digital currency you’re exchanging. It’s likewise normal for dealers to utilize a mix of time spans to go with very much educated choices.

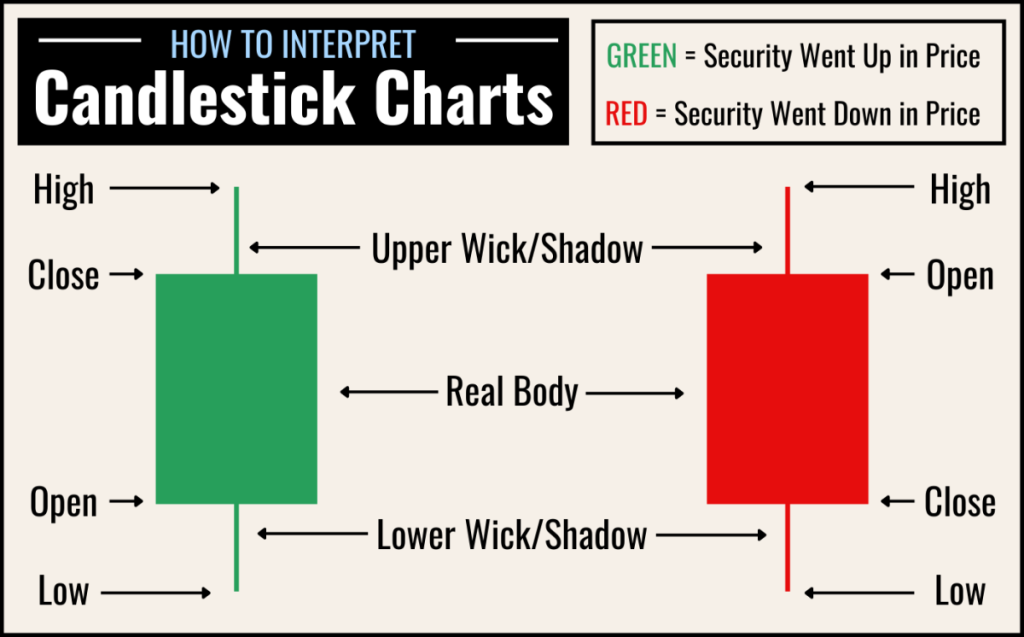

Understanding Basic Candlestick Charts

Candle diagrams are broadly utilized in crypto exchanging. Every candle addresses a particular time span and shows the opening, shutting, high, and low costs during that period. A green (or white) flame shows a cost increment, while a red (or dark) candle demonstrates a diminishing.

It seems like there may be a little disarray in your wording. Conceivable no doubt about it “Candle Outlines” or “Candle Graphs” while examining candle related visual portrayals with regards to monetary business sectors, including digital currencies. Allow me to give some data on candle diagrams:

Candle Graphs:

Candle outlines are a famous sort of monetary graph used to address the value developments of a resource, like a cryptographic money, over a particular period. Every candle commonly addresses the open, high, low, and close costs for a specific time frame stretch, whether it’s a moment, hour, day, and so on.

This is the way to decipher a candle:

Body: The rectangular region between the open and close costs. On the off chance that the nearby is higher than the open, the body is in many cases filled or hued, addressing a bullish (up) development. On the off chance that the nearby is lower than the open, the body might be empty or an alternate tone, demonstrating a negative (descending) development.

Wicks (or Shadows): The lines above and underneath the body address the most noteworthy and least costs during the time span. The upper wick stretches out from the highest point of the body to the greatest cost, and the lower wick reaches out from the lower part of the body to the most minimal cost.

Understanding candle examples and developments is vital for specialized examination. A few normal examples incorporate doji, hammer, meteorite, inundating, and that’s just the beginning. These examples can give bits of knowledge into potential market inversions or continuations.

In the event that you were alluding to an alternate idea with “Flame Outlines,” if it’s not too much trouble, give extra subtleties, and I’ll give my all to help you!

Candle Examples:

Learn normal candle designs (e.g., doji, hammer, inundating) as they can give bits of knowledge into potential value inversions or continuations.

Trendline: What It Is, The way To Involve It in Financial planning

Trendlines are a crucial device in specialized examination used to recognize and picture the bearing of a cost pattern for a monetary resource, including digital currencies. They help brokers and experts to come to informed conclusions about expected passage and leave focuses on the lookout. This is the way trendlines work:

Drawing Trendlines:

Upswing: Interface a progression of more promising low points. The line ought to incline up.

Downtrend: Interface a progression of worse high points. The line ought to slant descending.

Even Trendline: Addresses a reach where the cost is moving sideways. Interface highs or lows that seem to frame an even line.

Deciphering Trendlines:

Backing and Obstruction: In an upturn, the trendline frequently goes about as help, keeping the cost from falling underneath. In a downtrend, the trendline may go about as obstruction, covering up developments.

Breakouts and Breakdowns: A breakout happens when the cost moves over a downtrend line, demonstrating a likely inversion or speed increase of the pattern. On the other hand, a breakdown happens when the cost moves under an upswing line, proposing a possible shift in pattern course.

- Approving Trendlines:

The more times a trendline is contacted or regarded, the more substantial it is thought of. Various resources increment the meaning of the trendline.

Drawing Channels:

Channels are framed by defining equal boundaries around a trendline. They make a visual portrayal of the cost development inside a characterized range.

- Time spans and Trendlines:

Trendlines can be drawn on different time spans. Present moment trendlines might be more pertinent for informal investors, while longer-term trendlines are significant for financial backers.

- Changing Trendlines:

Markets are dynamic, so trendlines may require change as new cost information opens up. Continuously rethink and adjust your trendlines to mirror the latest economic situations.

- Affirmation with Different Markers:

It’s frequently helpful to affirm trendline examination with other specialized markers, like moving midpoints, to reinforce your dynamic interaction.

- Trendline Examples:

Certain examples framed by trendlines, like triangles (climbing, sliding, and balanced) and wedges, can offer extra experiences into potential future cost developments.

Recollect that while trendlines are significant devices, no single pointer ensures precise expectations. They ought to be utilized related to other investigation techniques and hazard the board systems. It’s additionally vital to think about the more extensive market setting, news, and outside factors that might affect the digital money market.

Backing and Opposition Levels:

It seems like there may be a slight disarray in your phrasing. The right terms are “Backing and Obstruction Levels,” not “Sponsorship and Resistance Levels.” Let me give a clarification of help and opposition levels with regards to exchanging and specialized investigation:

Support Levels Crypto Charting:

Support levels are cost levels where a monetary resource, like a digital currency, will in general quit falling and may try and return quickly upwards. It addresses a district where purchasing interest is serious areas of strength for essentially, the cost from declining further. Dealers frequently notice support levels to distinguish potential section focuses or set stop-misfortune orders.

Opposition Levels Crypto Charting:

Obstruction levels are cost levels where a resource will in general quit rising and may confront trouble getting through. It means where selling pressure becomes significant, keeping the cost from moving higher. Obstruction levels are vital for merchants to distinguish potential leave focuses or expect an inversion in the pattern.

Instructions to Distinguish Backing and Obstruction:

Authentic Value Levels: Search for verifiable levels where the cost has more than once bobbed off (support) or confronted dismissal (opposition).

Round Numbers: Mental levels, like round numbers or critical figures, frequently go about as help or obstruction.

Trendlines: Trendlines can go about as powerful help or obstruction, particularly in moving business sectors.

Moving Midpoints: Certain moving midpoints, similar to the 50-day or 200-day moving normal, can go about as help or opposition levels.

Outline Examples: Examples like twofold tops, twofold bottoms, and head and shoulders can demonstrate expected help or opposition zones.

Job Inversion:

When a help level is penetrated, it might go about as an opposition level from here on out, as well as the other way around. This job inversion is a typical peculiarity in specialized examination.

Breakouts and Breakdowns:

A breakout happens when the cost moves over an opposition level, proposing possible vertical energy. On the other hand, a breakdown happens when the cost moves under a help level, demonstrating likely descending strain.

Volume Investigation:

Examining exchanging volume at help and obstruction levels can give experiences. For instance, high volume during a breakout might affirm the strength of the move.

Different Time spans:

Consider checking backing and opposition levels on different time periods. Solid levels on higher time spans might have more importance. Understanding help and obstruction levels is significant for specialized investigation as they assist merchants with arriving at informed conclusions about section and leave focuses, stop-misfortune situation, and in general market opinion. Involving these levels related to other specialized pointers and examination techniques for an exhaustive perspective on the market is significant.

Crypto Market Cap Diagrams and Volume Graphs

Volume is a critical measurement in specialized examination that addresses the quantity of offers or agreements exchanged a given security or market during a particular timeframe. With regards to cryptographic forms of money or any monetary instrument, volume is a key pointer used to examine the strength and manageability of a cost pattern.

Here is a more critical gander at how volume is utilized in graph examination:

Translation of Volume:

Expanding Volume: An ascending or high volume frequently affirms the strength of a cost move. For instance, on the off chance that the cost is going up joined by a flood in exchanging volume, it proposes solid purchasing interest. This is in many cases considered a bullish sign.

Diminishing Volume: A lessening in volume during a value move might demonstrate debilitating interest and an expected inversion. Merchants frequently search for affirmation from both cost and volume patterns to settle on additional educated choices.

Spikes in Volume: Unexpected spikes in volume, particularly when joined by critical cost changes, can show the beginning of a recent fad or the continuation of a current one.

Affirmation of Patterns:

Volume can be utilized to affirm the legitimacy of a cost pattern. In an upswing, expanding volume upholds the vertical development, while in a downtrend, expanding volume affirms the descending development.

Volume Examples:

Peak Volume: Very high volume frequently happens toward the finish of a pattern or during key market inversions, flagging a possible peak or fatigue.

Volume Uniqueness: In the event that the cost is moving in one heading, however the volume is diminishing, it might show a possible inversion. This is known as volume disparity.

Volume Examination with Different Markers:

Consolidating volume examination with other specialized pointers, for example, Moving Midpoints or the General Strength File (RSI), can give a more complete comprehension of market elements.

Volume Profile:

Volume profile is a graphical portrayal of how much volume happens at each cost level over a predefined period. It recognizes areas of high and low interest, which can go about as expected help or obstruction levels.

News and Occasions:

With regards to exchanging and effective money management, remaining informed about news and occasions is critical as they can essentially affect monetary business sectors, including digital currencies. This is the way news and occasions can impact the market and a few contemplations for dealers and financial backers:

1. Market Feeling:

Positive News: Positive turns of events, like associations, mechanical progressions, or administrative help, can support market feeling and lead to expanded purchasing action.

Negative News: On the other hand, negative news, similar to security breaks, administrative crackdowns, or horrible mechanical turns of events, can make alarm, bringing about selling pressure.

2. Unpredictability:

News can acquaint unpredictability with the market. Abrupt and startling declarations frequently lead to quick cost developments, offering the two potential open doors and dangers.

3. Basic Examination:

News and occasions are basic to key investigation. This examination considers the fundamental factors that might impact a resource’s worth, like fiscal summaries, financial pointers, and, significantly, news about the resource and its environment.

4. Profit Reports:

For stocks and certain digital currencies, profit reports can altogether affect costs. Positive monetary outcomes might prompt expanded financial backer certainty, while frustrating outcomes can set off sell-offs.

5. Administrative Turns of events:

News connected with administrative choices, explanations from government authorities, or legitimate improvements can significantly affect the digital money market. Lucidity or vulnerability in regards to guidelines can influence market feeling.

6. National Bank Declarations:

Articulations from national banks about financial approach, loan fees, or monetary circumstances can impact money markets and, in a roundabout way, influence digital currencies.

7. Worldwide Financial Occasions:

Occasions like monetary pointers, international pressures, or worldwide monetary emergencies can impact the more extensive monetary business sectors, including digital forms of money.

8. Starting Coin Contributions (ICOs) and Token Deals:

Declarations connected with ICOs, token deals, or raising support exercises inside the crypto space can influence the costs of the elaborate digital currencies.

9. Innovation Overhauls and Forks:

News about innovation overhauls, forks, or significant achievements in the improvement of a blockchain venture can influence the apparent worth of the related digital currency.

10. Web-based Entertainment and Local area Feeling:

Word frequently gets out through web-based entertainment stages and online networks. Observing social opinion can give bits of knowledge into market responses.

Contemplations for Brokers and Financial backers:

- Ideal Data: Remain refreshed with ongoing news through dependable sources, news sites, and web-based entertainment channels.

- Check: Confirm news from various sources to guarantee exactness. Falsehood or reports can prompt market changes.

- Market Response: Guess how the market could respond to explicit news. Foster a system that lines up with expected results.

- Risk The board: Be ready for unexpected cost developments and integrate risk the executives procedures, including setting stop-misfortune orders.

Long haul Effect: Survey whether news has present moment or long haul suggestions. A few occasions might have a transitory effect, while others can shape the market for a drawn out period.