Crypto charges consistence alludes to the commitment of digital currency holders and brokers to report their digital money exchanges to burden specialists and make good on any material duties. Here is an outline of key perspectives connected with crypto charges consistence:

Taxable Events Crypto Taxes Compliance

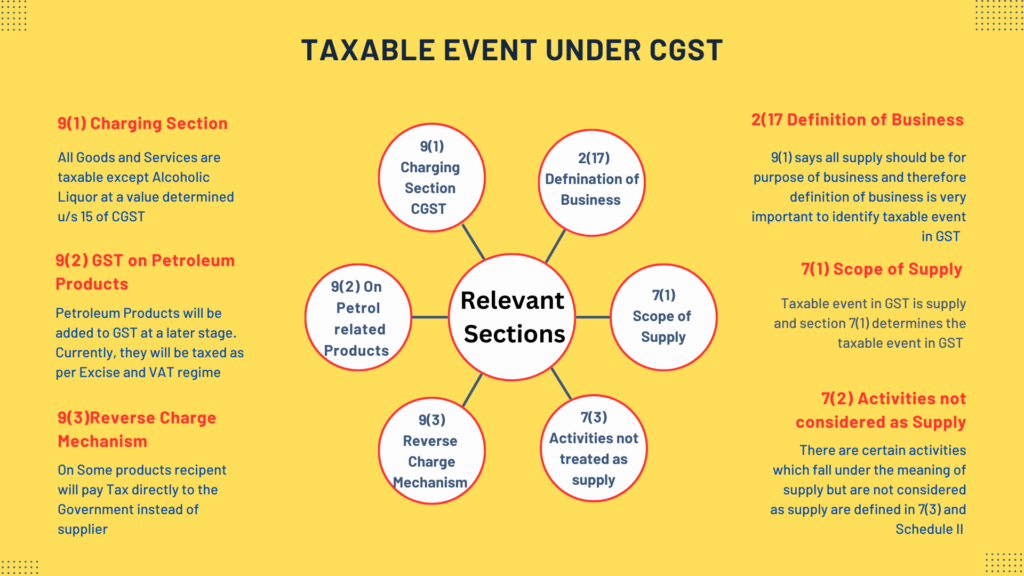

Available occasions with regards to digital currency allude to explicit exchanges or exercises including cryptographic forms of money that trigger an expense risk. The specific available occasions can fluctuate contingent upon the expense regulations and guidelines of every ward, except normal available occasions commonly include:

Cryptocurrency Sales:At the point when you sell or trade digital currencies for government issued money (like USD, EUR, and so on) or other cryptographic forms of money, any subsequent increases or misfortunes might be dependent upon tax collection. Crypto-to-Crypto Trades: Exchanging one digital money for another is typically viewed as an available occasion. The worth of the digital currencies at the hour of the exchange is utilized to compute any additions or misfortunes. Mining Rewards: Mining digital currency includes approving exchanges on a blockchain network and getting prizes as recently made coins or exchange charges. These prizes are in many cases considered available pay at their honest assessment at the hour of receipt.

Income Received in Cryptocurrency: In the event that you get digital money as installment for labor and products, or as pay from exercises like marking or airdrops, the worth of the digital money at the hour of receipt is normally viewed as available pay. Using Cryptocurrency for Purchases:Spending digital currency on labor and products may likewise be an available occasion, as it could bring about a capital increase or misfortune relying upon the contrast between the cryptographic money’s expense premise and its honest evaluation at the hour of the exchange.

Cryptocurrency Gifts and Donations:Giving cryptographic money as a gift or giving it to a foundation might have charge suggestions for both the provider and the beneficiary, contingent upon the locale and the sum in question. It’s significant for note that accuse guidelines of regard to computerized monetary standards can be astounding and may vary generally beginning with one district then onto the following. Along these lines, individuals partook in computerized money trades should learn about the specific appraisal rules significant in their country or search for heading from charge specialists to ensure consistence.

Tax Reporting

Charge announcing for digital money exchanges regularly includes a few vital stages to guarantee consistence with charge regulations. Here is a breakdown of the interaction. Gather Transaction Data: Gather all significant data with respect to your digital currency exchanges all through the fiscal year. This incorporates records of buys, deals, exchanges, changes, mining rewards, airdrops, marking rewards, and some other exercises including digital currency. Calculate Gains and Losses: Decide the additions or misfortunes for each available occasion. This includes working out the contrast between the returns (the honest assessment of the digital currency got) and the expense premise (the first price tag or honest assessment at the hour of securing). Monitor any exchange charges or different costs related with every exchange, as they can influence the available sum.

Classify Transactions: Arrange every digital money exchange as per the duty rules material in your locale. Various sorts of exchanges might have different duty suggestions. Normal classifications incorporate buys, deals, exchanges, pay got, and presents or gifts. Fill Out Tax Forms: Complete the vital tax documents or timetables expected by your nation’s duty specialists. These structures might fluctuate relying upon your purview however generally incorporate structures for announcing capital increases and misfortunes, pay from digital currency related exercises, and some other pertinent data. Report Income: In the event that you got cryptographic money as pay from sources like work, mining, marking, or offering types of assistance, report this pay on your government form. Utilize the honest evaluation of the cryptographic money at the hour of receipt to decide the available sum.

Check for Specific Reporting Requirements:Know about a particular detailing prerequisites or limits for cryptographic money exchanges in your purview. A few nations might have extra detailing commitments or exclusions for particular kinds of exchanges. By following these steps and staying informed about the tax requirements in your jurisdiction, you can ensure compliance with tax laws and minimize the risk of penalties or audits related to your cryptocurrency activities.

Tax Rates

Charge rates on digital money exchanges can fluctuate essentially contingent upon a few elements, including the sort of exchange, the locale, and the singular’s duty circumstance. Here is an overall outline of the various kinds of expenses that might apply to digital currency exchanges and the relating charge rates in certain nations. Capital Gains Tax (CGT): In numerous nations, benefits from the deal or trade of digital forms of money are dependent upon capital additions charge.Charge rates for capital increases can change in light of the holding time of the resource (transient versus long haul) and the singular’s personal expense section.Momentary capital additions are typically charged at higher rates than long haul capital increases.

Model rates: Transient capital increases charge rates line up with normal personal duty rates, which range from 10% to 37% (starting around 2022).Joined Realm: Capital additions charge rates for digital money territory from 10% to 20% for people (starting around 2024). Income Tax: Pay got from digital currency related exercises like mining, marking, or getting installments in cryptographic money is regularly dependent upon personal expense.Personal expense rates change in view of the singular’s complete pay and the relevant duty sections in the locale.

Model rates:

Australia: Personal expense rates for cryptographic money pay line up with common annual duty rates, which range from 19% to 45% (starting around 2024). Germany: Personal expense rates for cryptographic money pay are dependent upon moderate duty rates, which range from 0% to 45% (starting around 2024) Value Added Tax (VAT) or Goods and Services Tax (GST):A few nations force Tank or GST on digital currency exchanges, particularly on the acquisition of labor and products utilizing cryptographic money.Tank/GST rates shift by purview and may go from 0% to 25% or more.

Model rates:

European Association: Tank rates on digital currency exchanges change by EU part states however can go from 0% to the standard Tank pace of up to 27%. Corporate Tax:Organizations associated with digital currency related exercises might be dependent upon corporate personal expense on their benefits. Corporate expense rates shift generally by country and can go from single to twofold digits.

Model rates:Singapore: Corporate expense rate is a level pace of 17% (starting around 2022). US: Corporate cost rates range from 15% to 35% depending upon the association’s accessible compensation (beginning around 2022). Inheritance Tax:Digital currency resources moved as a feature of a legacy might be dependent upon legacy duty or domain charge. Legacy charge rates and edges differ by ward.

Joined Realm: Legacy charge rates on homes can go from 0% to 40% relying upon the worth of the domain and the relationship of the recipient to the departed. It’s essential to take note of that assessment rates and guidelines are liable to change, and the above models are for illustrative purposes as it were. Citizens ought to talk with charge experts or nearby expense specialists to comprehend the particular duty rates and decides that apply to their cryptographic money exchanges and their singular assessment circumstances.

Filing Deadlines

Documenting cutoff times for cryptographic money charges differ contingent upon the nation and the sort of government form being recorded. Here is an overall outline of documenting cutoff times for digital currency charges in a few purviews. United States:Individual Personal Assessment The cutoff time to document individual annual expense forms is commonly April fifteenth of every year. Nonetheless, the cutoff time might be stretched out to the accompanying work day if April fifteenth falls on an end of the week or occasion. Corporate Pay Tax: Partnerships should by and large document their annual expense forms by the fifteenth day of the fourth month following the finish of their fiscal year.

United Kingdom: Self-Evaluation Expense ReturnsThe cutoff time for recording self-appraisal assessment forms online is typically January 31st following the finish of the fiscal year. Paper assessment forms have a previous cutoff time, ordinarily in October. Partnership Duty Returns: Organizations should document their enterprise assessment forms in something like a year after the finish of their bookkeeping period. Australi:Individual Annual Duty The cutoff time for documenting individual personal expense forms is normally October 31st following the finish of the fiscal year. Notwithstanding, citizens who utilize an enlisted charge specialist might have later cutoff times. Organization Assessment forms Organizations should by and large hotel their government forms in something like a year after the finish of their pay year.

Germany:Personal Expense Returns**: The cutoff time for documenting annual expense forms is normally May 31st of the year following the finish of the fiscal year. Be that as it may, citizens who utilize a duty counsel might have later deadlines.Corporate Government forms Organizations should by and large document their assessment forms in something like seven months after the finish of their monetary year. Singapore: Individual Personal Expense The cutoff time for recording individual annual expense forms is normally April fifteenth of the year following the finish of the fiscal year. Corporate Pay TaxCompanies should by and large record their expense forms in somewhere around five months after the finish of their monetary year.

It’s vital for note that these cutoff times are liable to change, and citizens ought to constantly check with neighborhood charge specialists or talk with charge experts to affirm the particular recording cutoff times relevant to their circumstances. Also, citizens might demand augmentations in specific conditions, yet this normally requires documenting the suitable structures or warnings inside the first recording cutoff time.

Record-Keeping

Record-keeping is fundamental for cryptographic money exchanges to guarantee exact duty revealing and consistence with charge guidelines. Here is a manual for record-saving for digital currency exchanges. Transaction Details: Record subtleties of every digital currency exchange, including: Date and season of the exchange. Sort of exchange (purchase, sell, exchange, move, and so on.) Measure of digital currency included Cost of digital money in government issued money at the hour of the exchange. Exchange ID or hash Counterparty data (if appropriate)

Receipts and Invoices: Save duplicates of receipts and solicitations for cryptographic money buys, deals, and trades. These reports give proof of the exchange and assist with laying out the expense reason for capital additions computations. Wallet Addresses: Keep a record of wallet addresses related with your digital money exchanges. This data can assist with following the progression of assets and recognize the gatherings associated with every exchange. Cost Basis Calculation: Ascertain the expense reason for every digital currency exchange, including any charges or costs caused. The expense premise is utilized to decide the capital addition or misfortune when you discard the cryptographic money.

Exchange Record:On the off chance that you exchange digital forms of money on trades, track your exchanging action, including exchange history, request subtleties, and record articulations. These records give documentation of your exchanges and can be utilized to accommodate your exchanging action. Mining and Staking Records: Assuming you mine or stake digital forms of money, keep up with records of your mining or marking action, including rewards procured, dates of receipt, and the honest assessment of the prizes at the hour of receipt.

Income and Expenses: Track any digital money related pay you get, for example, installments for labor and products delivered in digital money. Additionally, track any costs connected with your cryptographic money exercises, for example, mining gear expenses or exchange charges. Regular Backup: Consistently reinforcement your exchange records and store them safely. Consider utilizing scrambled capacity or cloud-based administrations to protect your records against misfortune or robbery. Documentation of Tax Positions:Keep documentation of your expense positions and any applicable duty guidance got. This can incorporate expense forms, correspondence with charge specialists, and records of assessment related choices.

Retention Period: Hold your digital currency exchange records for the length expected by charge experts in your purview. Generally speaking, you might have to save records for essentially quite a long while after the fiscal year to which they relate. By keeping up with exact and coordinated records of your digital currency exchanges, you can guarantee consistence with charge guidelines and work on the course of duty detailing and review guard. In the event that you’re uncertain about record-keeping prerequisites or need help, consider talking with an expense proficient acquainted with digital money tax collection.

Generally, consistence with crypto charges is fundamental for people associated with digital money exchanges. to stay away from lawful issues and guarantee that they satisfy their duty commitments.